The effectiveness of advertising can be estimated in different ways — by the number of conversions to the website, cost per click, and many other indicators from analytics. But the supreme objective of any promotion is profit. Therefore, it is necessary to calculate it to evaluate the effectiveness of advertising. We explained which indicators are used to estimate the effectiveness of advertising in this article.

The effectiveness of advertising can be evaluated in different ways - by the number of clicks to the site, cost per click or many other analytics indicators. But the ultimate goal of any promotion is profit. It should be calculated to evaluate the effectiveness of advertising. In this article, we will tell you what indicators are used to calculate the effectiveness of advertising.

ROAS — Return On Ad Spend or return on advertising costs

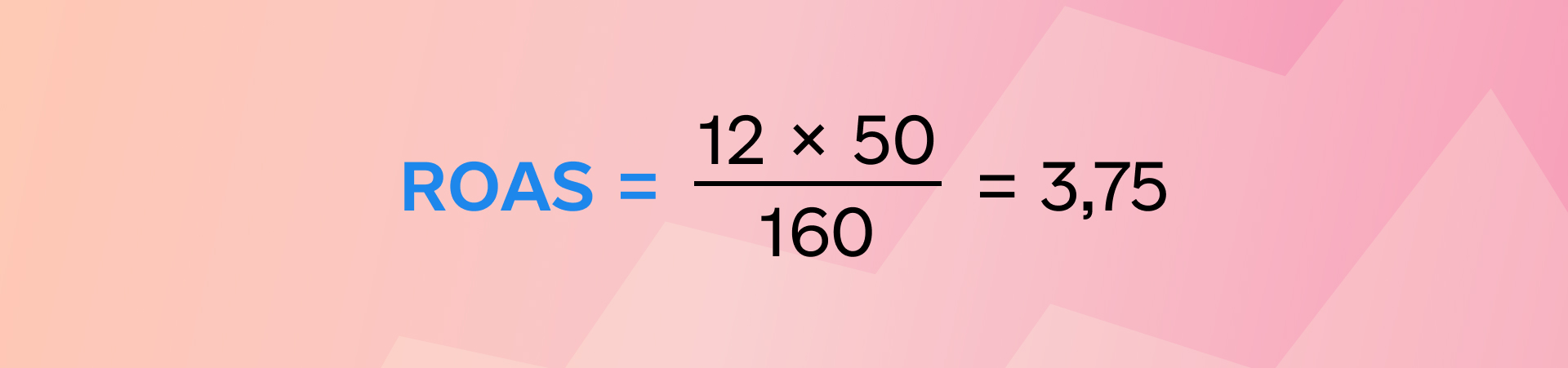

ROAS will help you find out whether you managed to earn more than you spent on an advertising campaign (AC). The coefficient is calculated as the income ratio from the advertising campaign to the cost of its implementation. For example, you spent $160 on Facebook Ads, and it gave 12 orders with an average check of $50.

For every dollar you spend, you get almost $4 in revenue. Sometimes, ROAS is expressed as a percentage, for which the coefficient is multiplied by 100%.

The ROAS disadvantage

The ROAS formula only includes advertising costs and does not include other related expenses. Therefore, we are talking about advertising revenue but not about profit. ROAS should not make conclusions about the advertising campaign's success - this indicator does not reflect the whole situation.

When to use ROAS

Despite its shortcomings, ROAS remains a valuable indicator. With its help, you can compare the effectiveness of promotion channels. By spending the same budget on several different channels you will find out the ROI of your advertising and choose the channel with the best performance.

Cost revenue ratio

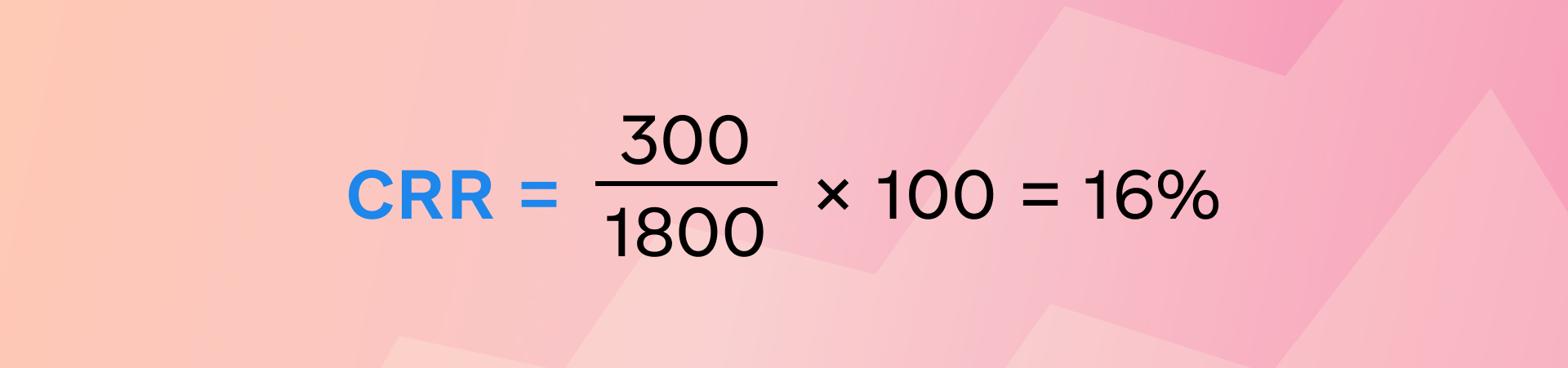

The cost revenue ratio, or CRR, shows how effectively money is spent on advertising. The CRR formula is like an inverted ROAS formula — the ratio of ad spend to ad revenue multiplied by 100%. For example, $300 was allocated for Google Ads contextual advertising with $1800 income.

16% of the RC revenue was spent on advertising. The smaller the share of advertising costs, the better the advertising campaign.

How to use CRR

CRR determines the profitability of investments in advertising, and fluctuations in the indicator can be a signal for optimizing costs. If in one month, the share of advertising costs was equal to 16%, and in the next month, you increased investments in advertising and CRR increased, your promotion methods have lost their effectiveness and need to be changed.

ROMI — Return On Marketing Investment or return on marketing investment

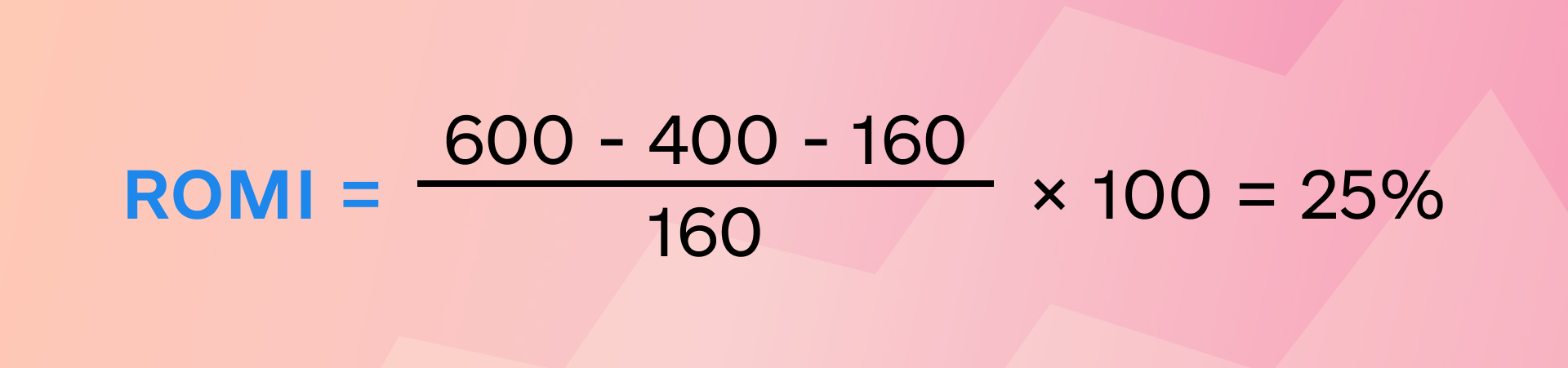

ROMI evaluates the effectiveness of the advertising campaign considering all costs. The calculation of return on marketing investment consists of several stages.

-

We take income from AC — 12 orders of $50 each = $600.

-

We determine the gross profit by subtracting the cost of the product from the income — the costs of purchase, delivery, storage, etc. For example, if the price is $400, the profit is $200.

-

From $200, we will subtract advertising expenses — $160. So we get $40 net profit.

-

We divide net profit by marketing investment, multiply by 100% and get ROMI.

An indicator less than 100% indicates that the investment is unprofitable. Although we used the same data to calculate ROAS, the coefficient showed that advertising costs have paid off. Unlike ROAS, ROMI considers all costs and allows to objective assess the advertising effectiveness.

Features of using ROMI

Customers rarely act according to the algorithm "saw an ad > went to the site > placed an order". They may see an advertisement, get acquainted with the assortment, leave the store, remember it after a while, and return and buy the product in another reporting period. It is significant to understand that the effect of advertising is long-term, and ROMI does not consider it. Therefore, it is not suitable for strategic planning.

Errors in the calculation of ROMI

1. Missing part of the data. If you are not sure of the reliability of the indicators or cannot fully calculate the cost - it is better not to take up ROMI. A distortion of one index can completely change the final result.

2. Ignoring the cost price. There are ROMI formulas where income is used instead of gross profit. In this case, the payback can skyrocket, but the store will lose money.

3. Neglect of discounts. If there is a discount on the product within the advertising campaign, you need to consider it in the marketing costs.

4. Generalization of the indicator. You can't calculate ROMI for one month and then multiply by 12 and call it annual ROI. You have to calculate ROMI for each RC for a specific period.

5. Mixing of goods. The cost of goods sold may differ, and you should consider it. It is better to divide the goods into groups by margin and calculate the return on investment for each group.

LTV - Lifetime Value or customer lifetime value

ROAS and ROMI evaluate the effectiveness of advertising as if the customer bought the product once and will not return to the store again. But in practice, after a successful RC, you can get a loyal customer who will buy from you in the future. Lifetime Value or customer lifetime value will help you to determine the profit from customers at a distance. Thanks to it, you can calculate how much the store will receive from the buyer from the moment of attraction to his last purchase.

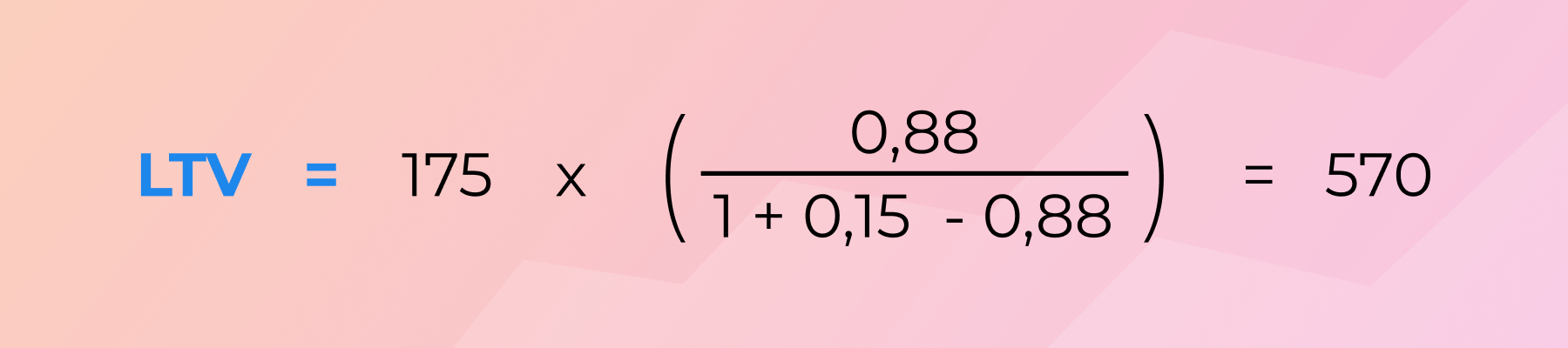

There are several formulas for calculating lifetime value. We will consider it not the most complicated of them. In addition to statistics from Google Analytics, you will need data from CRM for it. General view of the formula:

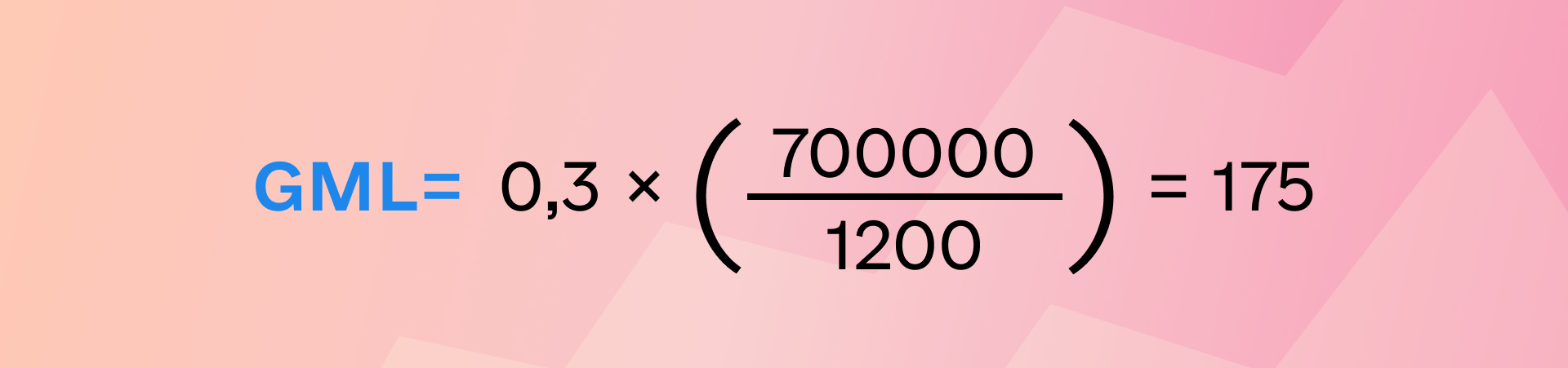

GML is the average profit from the customer for the entire time of his purchases in the store. GML is calculated as the store's total revenue ratio for the average customer retention period to the number of customers during this period, multiplied by the product margin.

Suppose that an online store retains a customer for 12 months. During this time, the revenue was $700000, with 1200 customers and an average product margin of 30%. Then GML is equal to:

On average, the store receives $175 from one customer.

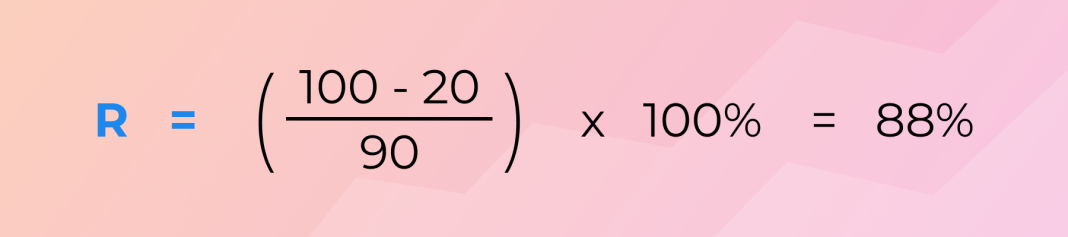

R is the customer retention rate. It shows the percentage of people who made a repeat purchase during a given period compared to the previous one. For example, at the beginning of the month, there were 90 customers. During the month, the store attracted 20 new customers, and for the whole month, there were 100 customers.

The store retains 88% of its customers.

D in the LTV formula means the discount at the time of the advertising campaign. If there was none, then this indicator can be skipped. We will imagine that it was 15%. Let's substitute all the values into the LTV formula and find out the lifetime value of the customer:

The customer's lifetime value is $570. That is the profit that can be expected from him for the entire time of his cooperation with the store.

LTV should be considered with customer acquisition cost (CAC). When LTV is three times more than CAC, it indicates business success. If the ratio is 1:1, the store is operating at a loss, and 5:1 demonstrates that you are not investing enough in marketing.

Conclusions

Advertising is the driving force of an online store, and it is significant to calculate its effectiveness to understand the direction of its movement. ROAS, ROI, ROMI, and LTV indicators will help you optimize costs, adjust marketing processes, and get more profit.